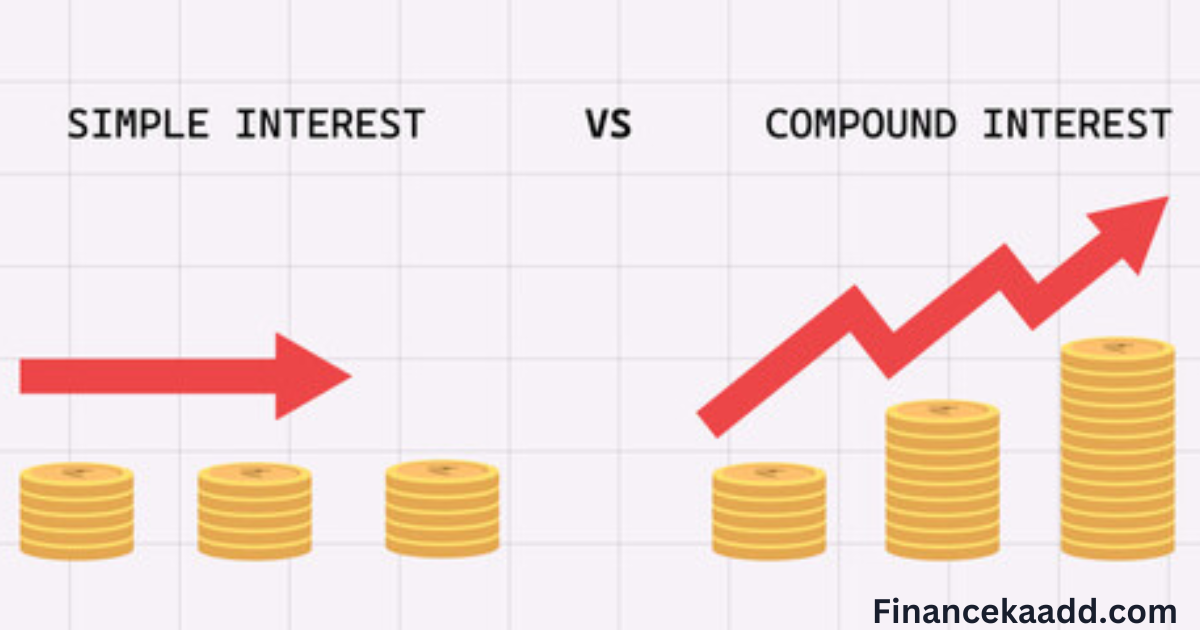

Simple Interest vs. Compound Interest, Understanding the dynamics of interest is crucial. Whether you’re borrowing money or saving, the type of interest involved can significantly impact your financial outcomes. Let’s delve into the disparities between simple interest and compound interest to grasp their implications better.

Exploring Simple Interest vs. Compound Interest

Simple interest operates on a straightforward principle: it’s calculated solely based on the initial amount, known as the principal. Imagine you deposit $1000 into a savings account with a simple interest rate of 5%. Each year, you’ll earn $50 ($1000 * 0.05) in interest, regardless of how long the money remains in the account.

Deciphering Compound Interest

Compound interest adds a layer of complexity to the equation. Not only does it consider the principal amount, but it also takes into account the interest accumulated over time. This means that as your interest earns interest, your wealth grows exponentially.

Let’s revisit the previous example, but this time with compound interest. You deposit the same $1000 into an account with a compound interest rate of 5%. In the first year, you earn $50 in interest, just like with simple interest. However, in the second year, you’ll earn interest not just on the initial $1000 but also on the $50 interest earned in the first year. This compounding effect continues to amplify your earnings each year.

Real-World Implications

Understanding these concepts is pivotal to making informed financial decisions. Whether you’re saving for retirement, planning for a major purchase, or repaying a loan, the type of interest involved can significantly alter the outcome.

For instance, let’s consider the scenario of repaying a loan. With simple interest, your interest payments remain constant throughout the loan term since they’re based solely on the initial principal. However, with compound interest, your interest payments may increase over time as the interest accumulates on the outstanding balance.

AXIS BANK MUTUAL FUND👉APPLY NOW

Simple interest offers predictability, making it easier to calculate and plan for. On the other hand, compound interest presents an opportunity for exponential growth but requires a keen understanding to leverage effectively. By grasping the disparities between these two types of interest, you can navigate the financial landscape with confidence and optimize your wealth-building strategies.

Key Takeaways

- Understanding Interest: Interest serves as the price of borrowing money, involving a payment from the borrower to the lender as compensation for the loan.

- Simple Interest Overview: Simple interest typically constitutes an annual payment calculated as a percentage of the saved or borrowed sum, often referred to as the annual interest rate.

- Compound Interest Dynamics: Compound interest differs in that it accounts not only for the initial saved or borrowed amount but also for the interest accrued over time. This compounding effect leads to exponential growth in wealth accumulation.

- Financial Implications: While compound interest presents opportunities for increased earnings when saving, it can also translate to higher costs for borrowers due to the accumulating interest on the outstanding balance.

Calculating Simple Interest

Simple interest is computed using the following formula:

The formula for simple interest is as follows: “Simple interest equals principal (P) multiplied by the annual interest rate (r) multiplied by the term of the loan (n).”

Where:

P = Principal amount

The variable “r” represents the annual interest rate, which is expressed as a decimal.

n = Term of the loan, measured in years

To determine the simple interest, follow these steps:

Identify the principal amount. This refers to the original borrowed sum.

Determine Annual Interest Rate: Express the annual interest rate as a decimal instead of a percentage. To convert a percentage to a decimal, shift the decimal point two places to the left. For instance, 5% becomes 0.05.

Calculate Term of Loan: Determine the length of time the money will remain in the account or the duration of the loan, measured in years.

Compute Simple Interest: Multiply the principal amount (P) by the annual interest rate (r), and then by the term of the loan (n).

By following this process, you can accurately calculate the simple interest for any given loan or savings scenario.

BEST BOOK FOR COMPOUND INTEREST👉BUY NOW

Simple Interest Example

Let’s illustrate simple interest with a practical example:

Scenario:

A student secures a loan to cover one year of college tuition. The initial loan amount is $18,000, and the loan carries an annual interest rate of 6%. After graduating, the student secures employment, adopts frugal spending habits, and plans to repay the loan over a span of 3 years.

Calculation:

Identify the principal amount (P): $18,000

Determine Annual Interest Rate (r): 6% (converted to decimal, becomes 0.06)

Calculate simple interest for one year:

Simple Interest = P × r = $18,000 × 0.06 = $1,080

The student will pay $1,080 in interest annually.

Determine Term of Loan (n): 3 years

Compute the total interest paid:

Total Interest = Simple Interest per year × Term of Loan

= $1,080 × 3 = $3,240

In total, the student will pay $3,240 in interest over the 3-year repayment period. This example demonstrates how simple interest works in a real-world scenario, helping borrowers understand their financial obligations more clearly.

Total Amount Repaid

To determine the total amount the student will repay, including both the principal and all interest payments, follow these steps:

Calculate Simple Interest: Use the formula to find the total simple interest paid.

The total interest is calculated by multiplying the principal amount by the interest rate and the duration of time.

T= $18,000 × 0.06 × 3 = $3,240

The total simple interest paid is $3,240.

Add Principal and Interest: Add the principal amount ($18,000) to the total simple interest paid.

Total Amount Repaid = Principal + Total Interest

= $18,000 + $3,240

= $21,240

The student will repay a total of $21,240, encompassing the principal amount of $18,000 and $3,240 in simple interest payments, over the course of the 3-year loan repayment period. This calculation provides a comprehensive understanding of the financial commitment associated with borrowing money for college.

Understanding Compound Interest

Compound interest adds a layer of complexity to the concept of interest accumulation. Unlike simple interest, which remains constant over time, compound interest grows exponentially as it accrues interest on both the principal amount and any previously earned interest.

Dynamics of Compound Interest

Interest on Interest: With compound interest, you not only earn interest on the principal amount but also on any interest that has accumulated over time. This compounding effect leads to a faster growth rate compared to simple interest.

Financial Implications: Borrowers are required to pay interest not only on the principal amount but also on the accumulated interest. However, for savers, compound interest can translate into higher earnings over the long term, as the interest compounds over time.

Frequency of Compounding: Interest may compound at various intervals, such as daily, monthly, quarterly, or annually. The more frequent the compounding, the more significant the earnings. However, for simplicity, we will focus on annual compounding in this discussion.

Formula for Compound Interest

The formula used to compute compound interest is as stated below.

Compound Interest = P × (1 + r)^t – P

Where:

P = Principal amount

The variable “r” denotes the annual interest rate, which is stated as a decimal.

t = Number of years interest is applied

This formula accounts for the compounding effect, providing a comprehensive method for estimating compound interest earnings or payments over time.

BEST BOOK FOR COMPOUND INTEREST👉BUY NOW

Compound Interest Example

Let’s illustrate compound interest with a practical example using the following steps:

Step 1: Adjusting Annual Interest Rate

Add 1 to the annual interest rate.

Example:

If the interest rate is 10%, convert it to a decimal (0.10), then add 1.

So, 1 + 0.10 = 1.10.

Step 2: Multiplying by the Number of Years

Raise the adjusted interest rate to the power of the number of years in which interest is applied.

Example:

If borrowing for 2 years, multiply the adjusted interest rate by itself (square it).

So, 1.10 x 1.10 = 1.21.

Step 3: Multiplying by the Principal Amount

Multiply the principal amount by the result from Step 2.

Example:

If the principal amount is $100, multiply it by 1.21.

So, $100 * 1.21 = $121.

Step 4: Calculating Compound Interest

Deduct the principal amount from the outcome obtained in Step 1.

Example:

If $121 is the total amount and the principal is $100,.

So, $121 minus $100 = $21.

In this example, the compound interest earned over 2 years would be $21. This demonstrates how to manually calculate compound interest, providing a deeper understanding of the formula’s workings.

More Examples of Simple Interest vs. Compound Interest

Let’s delve into additional examples to compare simple interest and compound interest:

Example 1: Simple Interest

- Scenario: Investing $5,000 in a 1-year certificate of deposit (CD) with a simple interest rate of 3% per year.

- Calculation: $5,000 × 3% × 1 = $150

- Conclusion: After one year, you will earn $150 in interest.

Example 2: Simple Interest (Shorter Term)

- Scenario: Opting for a 4-month CD instead of a 1-year CD.

- Calculation: $5,000 × 3% × (4/12) = $50

- Conclusion: Cashing the CD after 4 months yields $50 in interest.

Example 3: Simple Interest (Loan Repayment)

- Scenario: Borrowing $500,000 for 3 years at a 5% simple interest rate to fund a business venture.

- Calculation (Annual Interest): $500,000 × 5% × 1 = $25,000

- Conclusion: $25,000 in interest charges annually for 3 years.

- Calculation (Total Interest): $25,000 × 3 = $75,000

- Conclusion: Total interest charges amount to $75,000 after 3 years.

Example 4: Compound Interest

- Scenario: Seeking an additional $500,000 loan for 3 years with a 5% annual interest rate compounded annually.

- Calculation: Compound interest accrues on the principal and accumulated interest.

- Conclusion: The total interest paid would depend on the specific compounding schedule and formula used.

Summary

These examples highlight the differences between simple interest and compound interest, showcasing how the type of interest and the duration of the investment or loan can significantly impact the amount earned or paid over time.

AXIS BANK MUTUAL FUND👉APPLY NOW

Total Interest Payable After Three Years

Let’s calculate the total interest payable after three years, considering compound interest:

Breakdown of Annual Interest Payments

Year One: $25,000

Year Two: $26,250

Year Three: $27,562.50

Total Interest Payable Calculation

Total Interest Payable After Three Years:

$78,812.50 = $25,000 + $26,250 + $27,562.50

Alternative Calculation using Compound Interest Formula

Total Interest Payable After Three Years:

$78,812.50 = $500,000 × (1 + 0.05)^3 – $500,000

These calculations illustrate how compound interest rapidly accumulates over time, especially with long-term loans. It’s crucial to carefully consider the implications of compound interest when taking out significant loans with extended repayment periods, as the total interest payable can substantially impact the overall cost of borrowing.

Which is better, simple or compound interest?

The preference between simple and compound interest depends on whether you’re saving or borrowing money. Here’s a breakdown:

Compound interest is ideal for savers and lenders. When saving money or being repaid for a loan, compound interest results in higher earnings over time.

Simple interest is more advantageous for borrowers. Borrowers pay less over time with simple interest, making it a favorable option for loan repayment.

Additionally, calculating cumulative interest payments on a loan is straightforward with simple interest. You can simply sum the interest payments to determine the total amount paid over a given time frame.

How Do Teens Benefit From Compound Interest?

Teens stand to gain significantly from compound interest, thanks to their youth and the advantage of time. Here’s how:

Early Start: By starting to save money at a young age, teens can maximize the benefits of compound interest. The longer the money remains invested, the more it can grow over time.

Compounding Effect: Compound interest allows teens to earn interest on both the initial investment and the accumulated interest. This compounding effect accelerates wealth accumulation, resulting in higher earnings with each compounding period.

Regular Contributions: Teens can further boost their earnings by consistently adding to their savings. Regular contributions increase the principal amount, leading to even greater compound interest earnings over time.

Overall, compound interest empowers teens to build substantial savings and financial security for the future, highlighting the importance of starting early and making consistent contributions to their savings accounts.

Understanding the Rule of 72

The Rule of 72 serves as a handy tool for estimating the time it takes for an investment to double in value, given a fixed annual interest rate. Here’s how it works:

- Calculation: Divide the number 72 by your investment’s annual interest rate.

- For instance, if your interest rate is 4%, divide 72 by 4.

- So, 72 ÷ 4 = 18.

- Interpretation: The result indicates approximately how many years it will take for your investment to double in value.

- In this example, with a 4% interest rate, it will take roughly 18 years for your investment to double.

Accuracy and Applicability

- The Rule of 72 is particularly useful for estimating doubling times at lower rates of return.

- While it provides a quick estimate, it may not be perfectly accurate for higher interest rates or more complex investment scenarios.

- Nevertheless, it offers a valuable rule of thumb for investors seeking a rough estimate of their investment’s growth potential over time.

Bottom Line: Simple vs. Compound Interest

Interest, whether simple or compound, can be a complex topic to grasp. However, here’s the key takeaway:

- Compound Interest Advantage: Compound interest has the potential to significantly benefit savers, especially those who start saving at a young age. It allows your money to grow faster over time, even without additional contributions to your account.

- Borrowing Considerations: On the flip side, compound interest can result in higher costs for borrowers. The shorter the compounding period, the more you’ll pay over time if you have outstanding loans. It’s essential to understand these dynamics when borrowing money.

Financial Strategies

Understanding the principles of simple and compound interest can inform sound financial strategies.

- Early Saving: Starting to save early and leaving your money invested for as long as possible can maximize the benefits of compound interest, leading to substantial growth over time.

- Loan Repayment: Conversely, when dealing with loans, it’s generally advisable to pay them off as quickly as possible to minimize the impact of compound interest and reduce overall borrowing costs.

By comprehending these concepts and formulas, individuals can make informed decisions about their finances, optimizing savings growth and minimizing borrowing expenses.

FAQs

Q. What is compound interest?

Ans. Compound interest is the interest computed not only on the original principal amount but also on the interest earned from previous periods. It leads to exponential growth in the investment over time.

Q. How does compound interest differ from simple interest?

Ans. Simple interest is calculated only on the principal amount, while compound interest takes into account both the principal and the accumulated interest.

Q. Which is better, simple or compound interest?

Ans. The preference depends on whether you’re saving or borrowing. Compound interest benefits savers by increasing their earnings over time, while simple interest may be more advantageous for borrowers as it involves lower costs.

Q. How does the Rule of 72 work?

Ans. The Rule of 72 is a quick method to estimate how long it will take for an investment to double in valueTo estimate the time it takes for an investment to double in value, divide 72 by the annual interest rate.

Q. Why is it important to start saving early?

Ans. Starting to save early allows you to take advantage of compound interest over a longer period, resulting in greater wealth accumulation in the long run.

Q. What factors affect the amount of interest paid or earned?

Ans. The principal amount, the annual interest rate, and the duration of the investment or loan term are the primary factors influencing the amount of interest paid or earned.

Q. How can I minimize the impact of compound interest when borrowing?

Ans. To minimize the impact of compound interest when borrowing, consider making larger or more frequent payments to reduce the outstanding balance and decrease the overall interest paid over time.

Q. What strategies can I use to maximize my savings growth?

Ans. To maximize savings growth, focus on consistently contributing to your savings account, taking advantage of employer-sponsored retirement plans, and investing in assets with compound growth potential.

Q. Are there any risks associated with compound interest?

Ans. While compound interest can accelerate wealth accumulation, there are risks such as fluctuations in interest rates, inflation, and market volatility that may affect investment returns.

Q. Where can I learn more about personal finance and investment strategies?

Ans. There are various resources available, including books, online courses, financial advisors, and reputable websites specializing in personal finance and investment education.